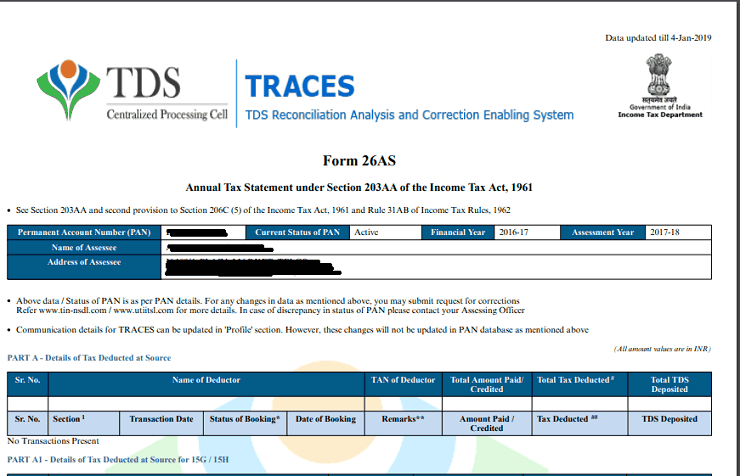

There must be no difference in the TDS amount being claimed in your tax return and the TDS amount updated in Form 26AS. You must make sure, the claims in Form 26AS match with all the taxes you have paid. Form 26AS is also proof of the TDS deducted by your buyer, bank or employer since it also contains details of the deductors. It is important to have Form 26AS handy while filing your tax returns and not just because it makes claiming tax credit easier. Form 26AS is a form that includes taxes deducted at source, taxes collected at source, details about deductions on high-value transactions, advance taxes and tax deducted for sale of property among other deductions.įorm 26AS is your single source for information on all the tax deductions made on your income.

0 kommentar(er)

0 kommentar(er)